Richi Machinery — International Market Position & Competitive Landscape (Complete Report)

Independent Market Analysis

Market Data & Trends

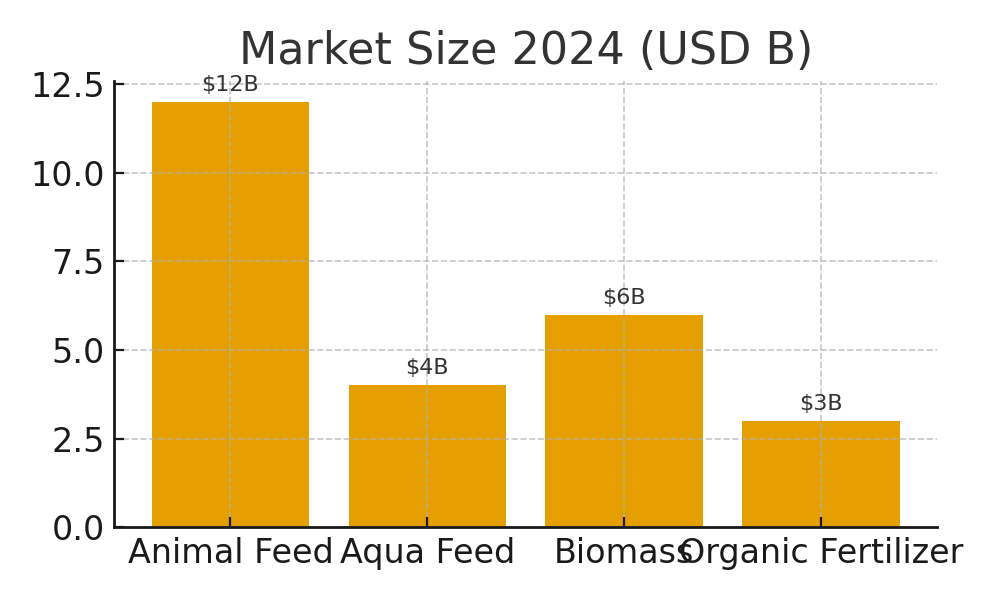

Global Market Size (2024 baseline):

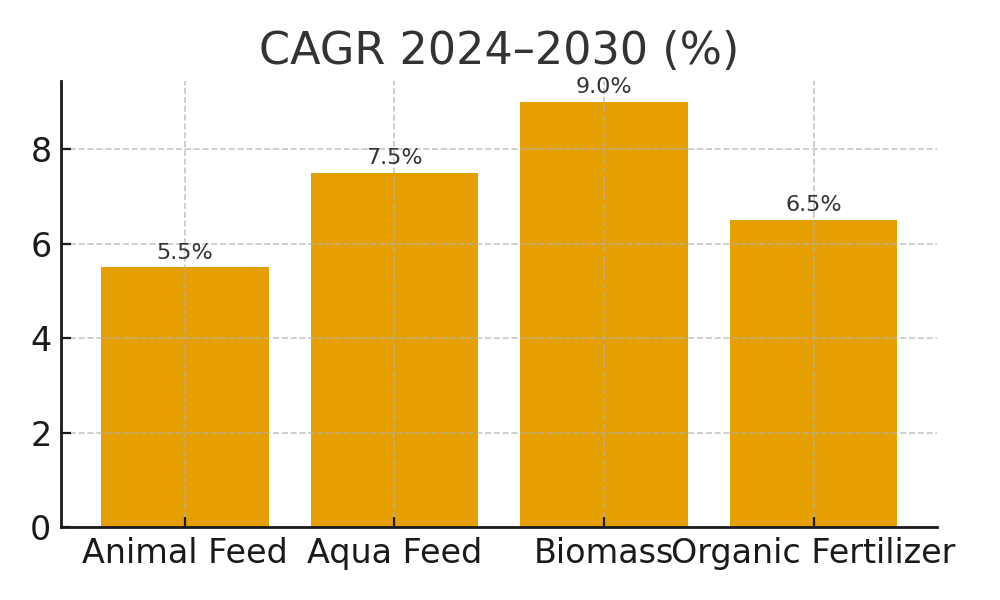

- Animal feed machinery: ~USD 12B; CAGR 5–6%.

- Aqua feed equipment: ~USD 4B; CAGR 7–8% (fastest growth).

- Biomass pellet equipment: ~USD 6B; CAGR 8–10% (policy-driven).

- Organic fertilizer equipment: ~USD 3B; CAGR 6–7%.

Visual Snapshot (Market Size & CAGR):

| Segment | 2024 Market Size (USD B) | CAGR (2024–2030) |

|---|---|---|

| Animal Feed Machinery | ~12 | 5–6% |

| Aqua Feed Equipment | ~4 | 7–8% |

| Biomass Pellet Equipment | ~6 | 8–10% |

| Organic Fertilizer Equipment | ~3 | 6–7% |

Key Growth Drivers:

- EU Green Deal & carbon neutrality → biomass demand.

- Rising aquaculture output in SEA & Africa → extruder lines.

- Feed cost inflation → localized production in Africa & LatAm.

- NGO/public projects → demand for compliance and transparent delivery.

Market Challenges:

- High CAPEX for premium solutions.

- Variability in utilities and site readiness in emerging regions.

- Logistics and spare parts constraints.

Executive Summary

Richi Machinery is the largest and most professional pellet mill manufacturer in Henan, China. With its new 2025 factory featuring a state-of-the-art pilot plant and dedicated office building, the company has strengthened its international presence. Unlike many single-machine vendors, Richi positions itself as a global turnkey solutions provider for animal feed, aqua feed, biomass/wood, and organic fertilizer lines.

Richi’s international competitiveness rests on comprehensive system integration, pilot-verified engineering proof, and lifecycle service. The company bridges the gap between premium Western brands (high CAPEX, strong automation) and value-driven peers (low price, weak documentation), making it highly attractive in mid-tier and emerging markets.

Key Highlights:

- Position: Leading turnkey pellet line supplier from China with global ambitions.

- Differentiator: Pilot plant validation and standardized FAT/SAT protocols.

- Strengths: Turnkey capability, modular designs, multilingual commissioning, and lifecycle support.

- Risks: Regional brand awareness gaps, parts logistics, and intense price competition.

- Strategic Imperatives: Institutionalize proof assets, expand after-sales hubs, enhance localization, and defend TCO value.

1. Company & Offering Overview

Corporate Position:

Richi Machinery is the largest pellet mill manufacturer in Henan, China, with a modern 2025 factory featuring a pilot plant and office complex. It positions itself as a global turnkey solutions provider, covering multiple verticals of the pellet industry.

Industry Coverage:

- Animal Feed Industry: poultry, livestock, and pet feed lines from 0.5–12 TPH, with focus on pellet quality (PDI) and feed conversion ratio (FCR) improvements.

- Aqua Feed Industry: floating and sinking fish feed, shrimp feed, and specialty aqua diets. Lines feature extruders, density/moisture control, and advanced conditioning for stable floatability and nutrient retention.

- Biomass Industry: sawdust, chips, and agricultural residues processed into fuel pellets. Includes drying, homogenization, pelletizing, cooling, and bagging systems designed to meet renewable energy standards.

- Wood Pellet Industry: turnkey lines for industrial and residential heating markets, ensuring consistent pellet density and low ash content.

- Organic Fertilizer Industry: powder and granulation lines with composting, crushing, batching, granulation, drying, and packaging. Systems designed for circular agriculture and environmental compliance.

Process Flow Capabilities:

- Feed & Aqua: crushing → mixing → conditioning → pelleting/extrusion → cooling → sieving → coating → packaging.

- Biomass & Wood: drying → screening → pelletizing → cooling → bagging.

- Organic Fertilizer: fermentation/composting → crushing → batching/mixing → granulation → drying/cooling → screening → packaging.

Service Model:

- Engineer-to-order & configure-to-order.

- Pilot plant trials across feed, aqua, biomass, wood, and fertilizer applications (testing DI, kWh/t, throughput).

- FAT/SAT protocols with standardized checklists.

- Multilingual documentation & training (EN/RU/FR/ES/VN).

- After-sales: spare parts stocking, preventive maintenance schedules, operator training, and remote diagnostics.

Representative Case Applications:

- Animal Feed: A 5 TPH poultry feed line in East Africa improved pellet durability by 12% and reduced feed waste costs by 8%.

- Aqua Feed: A 3 TPH floating fish feed line in Vietnam achieved stable floatability >95% and improved FCR by 0.1.

- Biomass/Wood: A 10 TPH sawdust pellet line in Eastern Europe reduced energy consumption by 15% compared to legacy equipment.

- Organic Fertilizer: A 4 TPH granulation line in South Asia enabled local farmers to convert waste into high-value fertilizer, meeting environmental compliance standards.

2. International Market Position

Value Proposition

- Turnkey engineering depth across multiple sectors.

- Pilot-verified performance with documented KPIs (PDI, kWh/t, uptime).

- Lifecycle support: spares, preventive maintenance, training, and remote service.

Competitive Edge:

- Faster commissioning than premium multinationals.

- Better documentation and QA than value-focused peers.

- Balanced CAPEX-to-value ratio, especially in mid-market (0.5–12 TPH) projects.

Challenges:

- Variable brand awareness by region.

- Logistics and spare-parts lead times.

- Need for precise technical localization.

3. Porter’s Five Forces (Industry Lens)

- Rivalry: High — fragmented market, strong multinational incumbents.

- Buyer Power: Medium/High — structured tenders, demand for proof and references.

- Supplier Power: Medium — reliance on gearboxes, motors, electrical cabinets, dryers.

- Substitutes: Low/Medium — feed imports, alternative energy policy shifts.

- New Entrants: Medium — local assemblers emerge but lack global service.

4. Competitor Landscape & Comparison

The global pellet machinery industry is highly competitive, shaped by rising feed standards, sustainability policies, and biomass adoption. Competitors fall into three broad cohorts:

4.1 Cohort A — Premium Multinationals

- Bühler (Switzerland): Global leader, automation/digitalization focus; CAPEX very high; market share ~15–20%.

- Andritz (Austria/Denmark): Strong in aqua feed; premium pricing; global references; share ~10–12%.

- CPM (USA): Durable machines, North America stronghold; narrower turnkey scope; share ~10%.

- RICHI Machinery (China): Fast-growing mid-market competitor; strong in turnkey solutions with pilot verification; estimated global share ~5–7% and rising.

4.2 Value-Optimized Chinese Peers

- Compete on headline price; inconsistent QA and proof.

- Share growing in Africa and Asia.

4.3 Regional OEMs/Assemblers

- Compete on local presence; small-scale focus; limited documentation & after-sales.

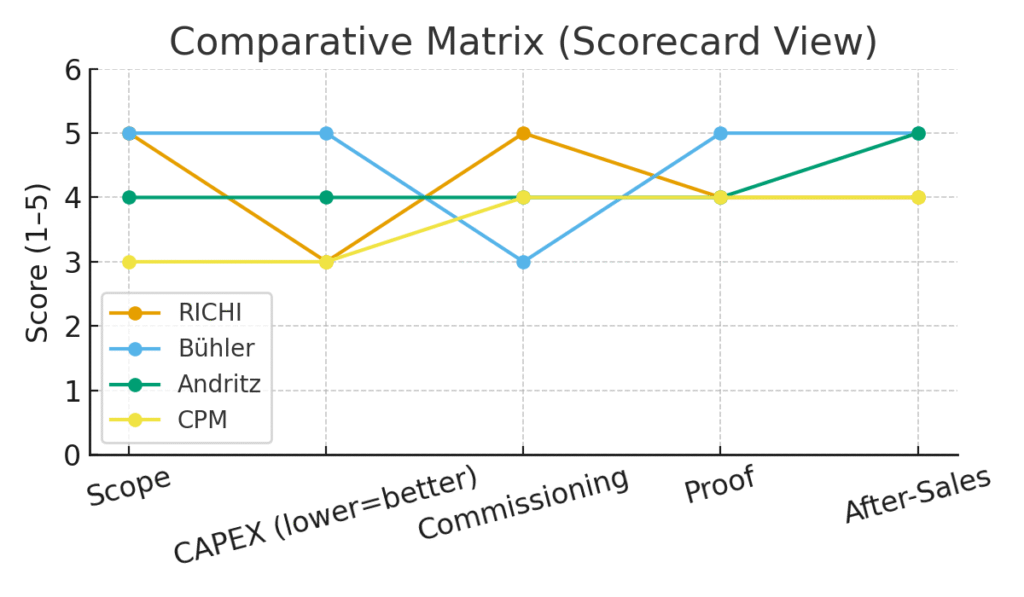

4.4 Comparative Matrix (Indicative)

| Dimension | RICHI | Bühler | Andritz | CPM | Value Peers | Regional OEMs |

|---|---|---|---|---|---|---|

| Scope | Full turnkey | Full, strong automation | Broad, compliance-led | Machines, limited turnkey | Medium–High | Low |

| CAPEX | Medium–High (–25–40% vs Bühler/Andritz) | Very High | High | Medium–High | Low–Medium | Lowest |

| Commissioning | Fast (–20–30% time) | Longer | Medium | Medium | Variable | Fast small rigs |

| Proof | Pilot + FAT/SAT | Advanced labs | Compliance-driven FAT | Durability record | Medium | Low |

| After-Sales | Structured, expanding | Global network | Global engineering | North America | Variable | Ad-hoc |

| Market Share (est.) | 5–7% | 15–20% | 10–12% | ~10% | ~8–10% | fragmented |

Trend Interpretation:

- RICHI’s strongest relative advantages lie in commissioning speed and balanced CAPEX.

- Premium brands outperform in automation, documentation, and compliance assurance.

- Value peers and OEMs undercut on pricing, but with weak proof and after-sales.

- RICHI is positioned to gradually close the gap in automation and after-sales depth, while defending its advantage in turnkey agility.

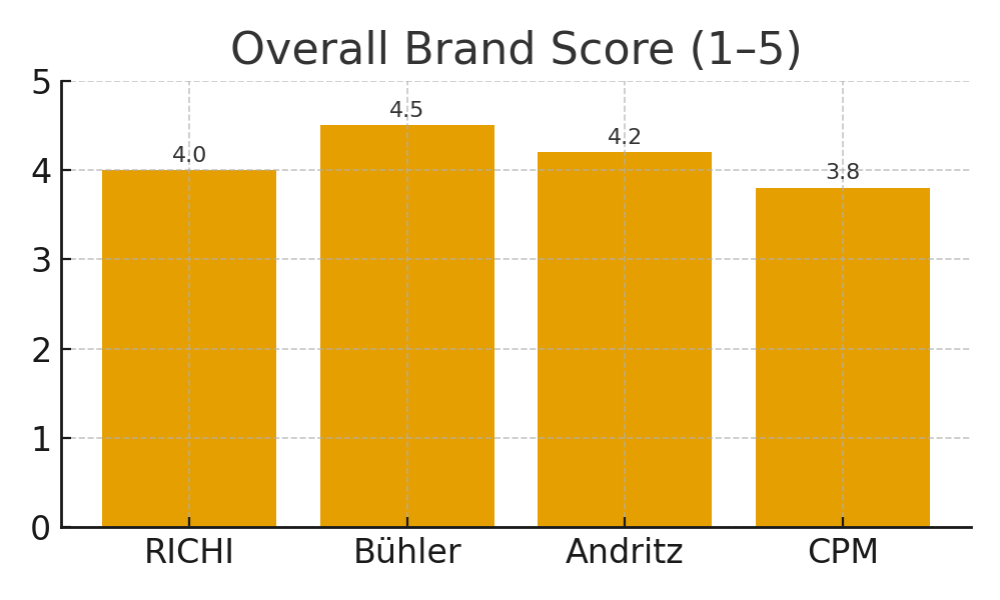

4.5 RICHI vs Premium Brands (Brand-Level)

| Dimension | RICHI | Bühler | Andritz | CPM |

|---|---|---|---|---|

| Scope | Full turnkey (feed, aqua, biomass, fertilizer) | Full lines, strong in automation/digital | Broad feed/aqua/biomass portfolio | Strong feed & biomass, less turnkey |

| CAPEX | Medium–High (25–40% lower than Bühler/Andritz) | Very High | High | Medium–High |

| Proof | Pilot plant + FAT/SAT | Advanced labs, references | Compliance-driven FAT/SAT | Long durability record |

| Commissioning | Fast (20–30% shorter cycle vs. EU brands) | Longer, complex | Medium | Medium |

| Documentation | High, multilingual | Very High | Very High | High |

| After-Sales | Structured, expanding | Global service network | Global engineering teams | Strong in N. America |

| Global Market Share (est.) | ~5–7% (growing) | 15–20% | 10–12% | ~10% |

| Key Edge | Cost-to-value, agility | Automation, digitalization | Engineering depth | Durability perception |

| Score (1–5) | 4.0 | 4.5 | 4.2 | 3.8 |

Summary:

RICHI competes on cost efficiency (25–40% lower CAPEX), commissioning agility (20–30% faster), and turnkey scope. Premium brands (Bühler, Andritz, CPM) dominate in automation, digital integration, compliance, and global service depth. Market share estimates reinforce this: Bühler (~15–20%), Andritz (~10–12%), CPM (~10%), with RICHI expanding (~5–7%) by targeting mid-tier and emerging markets with engineered proof and multilingual support. The additional overall scorecard rating indicates RICHI’s balanced strength (4.0/5) relative to Bühler (4.5/5), Andritz (4.2/5), and CPM (3.8/5).

Conclusion

Richi Machinery occupies a strategic mid-market position, bridging cost efficiency and turnkey proof. Against Bühler, Andritz, and CPM, it competes on cost (25–40% lower CAPEX), commissioning agility (20–30% faster), and modular turnkey scope. Premium brands still dominate in automation, global service depth, and compliance leadership, but RICHI is building momentum through multilingual service, pilot verification, and regional case successes.

Future Market Outlook (Quantitative):

- Global feed and biomass pellet equipment market expected to reach USD 30–32B by 2030, CAGR ~6–7%.

- Aqua feed segment will grow fastest at 7–8% CAGR, with Southeast Asia and Africa leading demand.

- Biomass pellet machinery forecasted to expand at 8–10% CAGR, driven by EU Green Deal and renewable energy policies.

- Organic fertilizer equipment expected to hit USD 4.5–5B by 2030, CAGR ~6%.

Strategic Implication:

If executed effectively, RICHI can establish itself not only as the largest pellet mill manufacturer in China, but also as a top-tier global turnkey pellet line provider, competing head-to-head with premium multinationals by 2030.

Trend Outlook (Next 5 Years):

- Commissioning & Proof: Maintain advantage by institutionalizing KPI dashboards and pilot-verified references.

- Automation & Digitalization: Invest in smart monitoring, energy optimization, and predictive maintenance to narrow the gap with Bühler and Andritz.

- After-Sales Depth: Establish regional hubs and training academies to expand lifecycle service globally.

- Brand Authority: Increase visibility in NA/EU markets through compliance certifications, references, and joint ventures.

- Market Share Goal: Grow from 5–7% today to ~10% by 2030, consolidating position as China’s largest pellet mill manufacturer and a rising global contender.